The 2022 Florida Legislative Session And Why It’s Important For Community Associations

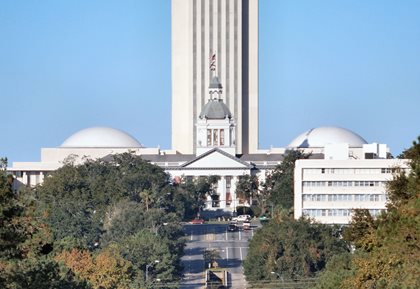

On January 11, state lawmakers will assemble for the annual 60-day legislative session. This session will cover a list of key issues and promises to be an active one for community associations for two particular reasons: the impact of the collapse of Champlain Towers South in Surfside and the skyrocketing cost of property insurance.

On January 11, state lawmakers will assemble for the annual 60-day legislative session. This session will cover a list of key issues and promises to be an active one for community associations for two particular reasons: the impact of the collapse of Champlain Towers South in Surfside and the skyrocketing cost of property insurance.

Condominium Safety and Reform

The tragic collapse of Champlain Towers South in Surfside on June 24, 2021, captured the attention of stakeholders across the country – condominium residents and board members, policymakers, regulators, attorneys, managers, realtors, mortgage companies, and insurance companies – leading to numerous discussions about condominium safety and reform. Since the building collapse, FirstService Residential has been meeting with Florida legislators who lead the state’s Surfside response efforts to share the thoughts and concerns of the community association board members we serve.

FirstService Residential has also provided policy recommendations to the Community Associations Institute (CAI) and the Real Property Probate and Trust Law Section of the Florida Bar (RPPTL). Each organization has assembled task forces to share best practices to help communities prevent similar tragedies. Both groups have issued reports recommending sweeping changes to Florida condominium laws.

The RPPTL Condominium Law and Policy Life Safety Advisory Task Force, consisting of a diverse group of condominium attorneys, has recommended changes to laws to ensure boards have the right to collect special assessments for major repairs to protect resident safety. It also recommended that associations have proper reserves for significant repairs beyond what is used for routine maintenance.

According to the 179-page report,* boards may sometimes resist maintenance recommendations due to cost, lack of reserves, disruption, and inconvenience. These new laws would ensure proper reserves are in place to make significant safety repairs to help prevent a catastrophe like the one in Surfside. The report added that while most condominium associations operate reasonably safely, more consistency is needed with inspections – and the information must be made available to residents.

Similarly, the CAI assembled a group of reserve analysts, attorneys, insurance, and other industry professionals, to provide recommendations that include reserve studies and funding and statutorily mandated building inspections to maintain structural integrity. The Condominium Safety Public Policy Report can be viewed here: Condominium Safety Public Policy Report

Proposed Legislation

Since the incident occurred, several bills have been filed, including one requiring associations to create a searchable database indicating whether the association maintains a reserve account for capital improvements and maintenance and whether that account is fully funded.

House Bill 329 and Senate Bill 642 would require that the database include names, mailing addresses, and email addresses for association board members and the association’s governing documents. Associations would also be required to list reserve studies and maintenance inspection reports in an effort to help promote greater transparency.

According to Anthony Kalliche, special counsel at FirstService Residential, it’s a bit early in the legislative process to know whether these and other bills will gain traction. “While there is a tremendous drive to do something legislatively in response to the Champlain Towers South tragedy, there is also a recognition that it’s difficult to create meaningful change without having all the facts,” he said. “There has been a lot of discussion about the need to focus on the availability of funds to finance needed repairs. As a result, we could see a legislative response addressing statutory reserves, including making it more difficult to waive reserves.”

Additional proposed changes to the legislation include House Bill 547 and Senate Bill 394, aimed at curbing fraud, that would increase penalties for board members who accept kickbacks. These measures would require condominium, cooperative, and homeowner association board members to take a state training course up to a year before or within 90 days of being elected or appointed. Board members would also be required to sign an affidavit attesting that they have read and will comply with association bylaws and post the affidavit and training certificate on a website. Failure to comply would risk removal from the board.

Safety bills that may be heard during the next legislative session include House Bill 375 and Senate Bill 940, which prohibit a person who is not a licensed professional structural engineer from claiming the title, ensuring an engineer’s qualifications.

Other aspects of building safety, including inspections, maintenance, reserves, transparency of records, and other safety concerns, will be addressed during the 2022 Florida legislative session. FirstService Residential will share and provide helpful information on each bill’s progress.

*The report includes many valuable recommendations; however, there are some problematic suggestions that appear to be beyond the intended scope of the report and which may have adverse consequences to community associations and their management firms. The report can be accessed here: Florida Bar Report

The Rising Cost of Property Insurance

Florida community associations and homeowners continue to struggle with soaring insurance rates or lack of coverage altogether. Some associations and homeowners are seeing rate increases of at least 20%, and some insurance carriers are pulling out of the market entirely.

Fraudulent roofing claims and increased litigation costs are partly fueling the problems we’re seeing in Florida’s insurance market, according to the Daytona Beach News Journal. Fraud and legal abuse amount to rising insurance costs for homeowners, which can lead to soaring insurance premiums.

“What’s occurring in the insurance market is unavoidable; however, boards and management companies can be proactive in the way they manage these increases. At FirstService Financial, our goal is to be transparent with the associations we partner with and provide realistic and helpful recommendations,” said John Lee, Vice President, FirstService Financial, the financial arm of FirstService Residential.

Legislative steps are being taken to help mitigate rising insurance costs. For example, this summer, Governor Ron DeSantis signed Senate Bill 76 into law. Backed by the Florida insurance industry and other stakeholders, the law restructures litigation rules for disputed insurance claims, disallowing contractors, public adjusters, and companies from using advertisements that encourage Floridians to make an insurance claim for roof damage.

The Florida legislature will address additional reform measures and, of course, FirstService Residential will continue to advocate for community associations before policymakers and regulators to address this ongoing issue.