Nearly every debate on New York City's housing crisis involves 485x, a new tax exemption program that Albany hopes will spur the construction of new affordable housing units and revive the multifamily development pipeline. The former abatement program for builders and developers, known as 421a, expired in 2022 and resulted in a near cessation of new multifamily residential construction at a time when dense metropolitan areas like New York City face a severe housing shortage.

Known also as the Affordable Neighborhoods for New Yorkers Program, 485x comprises a tiered system of tax breaks or incentives for developers that set aside a specific percentage of affordable housing units in newly constructed apartment buildings.

Led by New York State Governor Kathy Hochul, 485x was announced in April and is a major component of the state’s 2024 annual budget. Building owners, developers, and investors are now crunching numbers to calculate how valuable the new incentives are compared to 421a.

A brief history of 421a

In 1971, New York State created the 421a tax exemption program to incentivize the construction of new affordable housing units. The incentives helped balance the cost of designating a percentage of apartments as affordable housing units within a market-rate rental building. The level of incentives varied depending on how deeply affordable the units were priced, and the percentage of units designated as affordable housing.Properties that adhered to a strict set of housing requirements and filing schedules qualified for the

421a tax exemptions for up to 35 years.

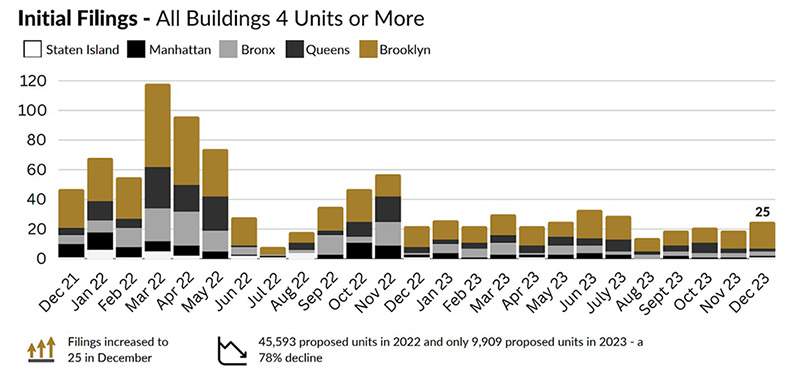

According to the Real Estate Board of New York (REBNY), after 421a expired in 2022, the number of permit applications and anticipated multifamily housing projects in New York City dropped a staggering 78%. In December 2023, there was only one DOB permit filed for a new building with more than 100 residential dwelling units.

Infographic: Real Estate Board of New York (REBNY), ‘Foundation Permit Report, December 2023.’

"The findings affirm what we’ve known for a long time — there’s an ongoing shortfall in the construction of multifamily rental housing, and the need for our leaders to work with the industry on a solution grows more and more urgent. [sic] That means we have to come together behind a comprehensive agenda that spurs construction that can increase our housing supply and help address the need for affordable housing."

— Carlo A. Scissura Esq., President and CEO | NY Building Congress

An extension of 421a tax incentives and construction deadlines

State officials estimate that the expiration of the 421a tax abatement program in 2022 has put the construction of 30,000 housing units in New York City at risk. In an effort to support housing projects currently under construction, Governor Hochul approved an extension of 421a construction deadlines for ongoing developments that previously qualified for the program. Under new legislation, housing projects currently vested in the program that began construction before June 2022, now have until June 2031 to be completed.Are 485x tax exemptions the solution to resuscitate New York City’s affordable housing development pipeline?

The 485x tax abatement program is Albany’s effort to replicate 421a program benefits with similar obligations for builders and developers to qualify. Here’s what’s new:- Extended tax exemptions – 485x extends the tax exemption period for builders and developers from 35 to 40 years. The goal is to make long-term investments in affordable housing more appealing to developers.

- Stricter affordability requirements – Under 421a, developers could designate affordable housing units for individuals and households at 130% Area Median Income (AMI). To support the creation of more deeply affordable units, 485x incentives are largely available for buildings with affordable housing components set between 60% and 80% AMI.

- Permanent affordability – 485x also mandates that the affordable units remain so, permanently.

- Increased wage requirements – Buildings that wish to receive 485x incentives must adhere to a sliding scale of wage requirements for construction workers. For example, properties with more than 100 units must enforce a minimum wage of at least $40 per hour for construction workers. This amount will increase 2.5% annually to keep pace with inflation.

The wage requirements also increase depending on the number of total units the property will yield, as well as its location. For example, new developments in Lower Manhattan and waterfront sections of Brooklyn and Queens must adhere to higher compensation rates than other areas of the city.

The novelty of 485x makes it hard to say if the incentives will invigorate affordable and market-rate housing development in New York City. Governor Hochul has expressed confidence that the incentives will have a positive impact on housing development. Read a full statement from the governor here.

"I promised New Yorkers that we’d tackle the housing affordability crisis – and in this budget, we got it done. As the first governor in half a century to put housing front and center, I will keep fighting to make our state more affordable and more livable and help every family achieve their New York dream."

— Kathy Hochul, New York State Governor

Governor Hochul has also passed a reform that eliminates the Floor Area Ratio (FAR) cap for residential buildings and created new tax incentives for office-to-residential conversions.

According to a report by the New York City comptroller, large multifamily rentals are normally taxed at twice the rate of condos and co-ops. As the city hopes to add 500,000 new homes within the next decade, they aim to accelerate construction by partnering with larger buildings through a few new programs:- Removing limitations on residential housing density – The floor-area-ratio (FAR) cap was introduced in 1961 to limit the density of New York City’s residential buildings by restricting their size relative to the size of the lot they were built on. The new budget has lifted the FAR cap to allow for higher density residential buildings.

- Tax exemptions for office-to-residential conversions – Recognizing increasing vacancy rates in office buildings and a shortage of residential housing, a new set of tax incentives will help offset the high costs associated with office-to-residential conversions. Buildings that set aside 25% of their converted units for affordable housing can receive a tax break for up to 35 years. The city estimates that these conversions could create over 20,000 new apartments.

- Guidelines for basement and cellar apartments – This budget includes a pilot program to legalize basement and cellar apartments within identified geographic locations in the City of New York and to ensure those apartments are brought up to code to allow individuals to live in them safely.

Our dedicated advisors have consulted on hundreds of new development projects to help builders capture valuable incentives and navigate complex eligibility requirements.

And it doesn’t stop there. More than 95% of our developer clients retain FirstService as their full-service management partner upon completion and opening. Here’s a snapshot of the services we offer to developers, owners, and investors:- Pre-development consulting and pre-opening management services that maximize return on investment.

- Full-service finance and accounting resources for budgeting, reporting, modeling, and more.

- Affordable housing compliance experts trained in finding qualified tenants and keeping properties in compliance with eligibility criteria.

- Dedicated owner's rep and construction management services for punch lists, residential and commercial build-outs, capital improvements, energy retrofits, and more.